A New Path to the United States,

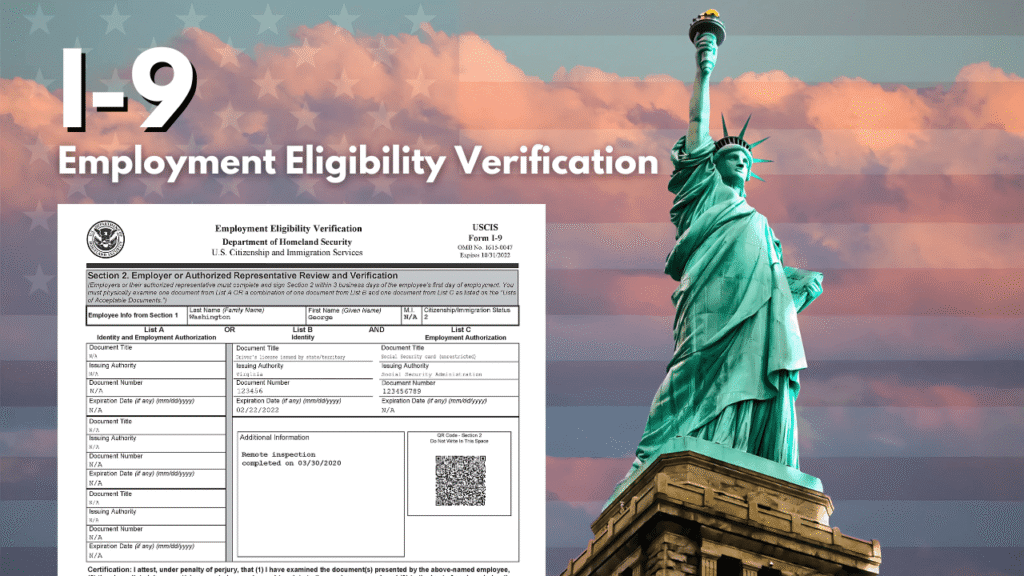

Everything You Need to Know About Form I-9, Employment Eligibility Verification

Mishandling Form I-9 can lead to serious penalties, making proper filing and storage critical. Adding to the complexity, the form has undergone several changes in recent years. That’s why we’re here—to bring you the latest updates and ensure you stay compliant.

Forms and Document Downloads

What is Form I-9?

Form I-9, officially known as the Employment Eligibility Verification Form, is required by the United States Citizenship and Immigration Services (USCIS). Every U.S. employer must complete this form for each new hire to confirm their eligibility to work in the country.

Whether you’re paying someone a salary, providing accommodations, transportation, or even meal plans, any form of remuneration triggers the requirement for an I-9.

Form I-9 isn’t new. It dates back to 1986, when Congress passed the Immigration Reform and Control Act under President Reagan. The form was created to prevent the hiring of unauthorized workers.

Key milestones include:

- 1990: Laws passed to prevent discriminatory practices during verification.

- 1996: Limits placed on acceptable verification documents.

- 2004: Electronic completion of the form became legal.

- 2007: The E-Verify program launched for digital processing.

- 2019-2023: Multiple updates to the form, with the most recent version required after October 31, 2023.

Who Fills Out Form I-9?

The responsibility for completing Form I-9 is shared between:

- The employee: completing Section 1

- The employer (or their authorized representative): completing Section 2

- A preparer or translator (if needed): assisting the employee

An authorized representative can be anyone the employer designates—but it’s crucial to select someone trustworthy and committed to compliance. Although technically anyone—even your neighbor—could fill this role, it’s best to rely on responsible internal staff.

Tip: A preparer or translator isn’t always necessary, but they can assist employees facing language barriers or other challenges.

How to Complete Form I-9

Section 1 (Employee’s Responsibility):

Employees must complete and sign Section 1 on or before their first day of work. They’ll provide:

- Full legal name (including former names)

- Address

- Date of birth

- Citizenship or immigration status

- Supporting identification numbers (if applicable)

Social Security Number, email, and phone number fields are optional unless using E-Verify.

Section 2 (Employer’s Responsibility):

Employers must complete Section 2 within three business days of the employee’s start date. They must review original documents and provide:

- Start date

- Employer information (business name, address)

- Details about the documents presented

- Signature and title

Using a Preparer or Translator:

If a preparer or translator assists, they must complete Supplement A to document their involvement.

Acceptable Documents for Form I-9

Employees must present:

- One document from List A, OR

- One document each from List B and List C

List A (proves both identity and work authorization):

Examples include a U.S. passport, permanent resident card, or foreign passport with proper authorization stamps.

List B (proves identity):

Driver’s licenses, state ID cards, and school IDs with photos are common examples.

List C (proves work authorization):

Social Security cards (without restrictions), birth certificates, or citizenship certificates.

How Long Should You Retain Form I-9?

Retention rules are strict:

- Keep the I-9 for as long as the employee is with your company.

- After employment ends, retain the form for:

- 3 years after the date of hire, or

- 1 year after termination—whichever is later.

Storage Options:

- Paper

- Microfilm

- Electronic systems (such as BerniePortal’s secure digital HRIS)

While it’s not legally required, many employers store I-9s separately from personnel files to make audits easier and protect sensitive information.

Is There a Deadline for Completing Form I-9?

Yes:

- Employees must complete Section 1 by their first day of work.

- Employers must complete Section 2 within 3 business days of the employee’s start date.

To streamline the process, many HR teams incorporate I-9 completion into their onboarding systems, ensuring compliance from day one.

Do You Need to File Form I-9 with the Government?

No.

Form I-9s are not filed with a government agency. However, employers must retain them and present them during an audit if requested. Failure to do so can result in fines or penalties.

Important:

While industries with high immigration rates (like agriculture or hospitality) are more likely to face audits, any employer can be subject to review. It’s better to be prepared.

Final Thoughts

Form I-9 compliance may seem complicated, but with the right systems and processes, you can manage it smoothly.

Keep up with changing regulations, store documents securely, and complete verifications on time—and you’ll protect your organization while creating a compliant and welcoming workplace.

Thanks for reading!